[Editor’s note: This is part one of a two-part column by guest author Andrew Hetzel. Daily Coffee News does not engage in sponsored content of any kind, and all views or opinions expressed in this piece are those of the author/s.]

Agriculture is a number one explanation for land use change and deforestation, and the second largest emitter of greenhouse gasses behind burning fossil fuels. To cut back the adversarial results of farming on the local weather, the European Union handed landmark laws in 2023 requiring seven agricultural commodities to be confirmed “deforestation free” earlier than importation.

Enforcement of the European Union Deforestation-free Regulation (EUDR) begins in January 2025. Espresso, claimed to signify 7% of EU-driven deforestation, is among the regulation’s regulated commodities.

Whereas applauded as a big environmental milestone, EUDR’s design fails to think about complicated smallholder agricultural provide chains, resembling these present in espresso. Espresso is farmed by thousands and thousands of smallholders within the World South, the place guidelines prescribed by distant lawmakers could also be incompatible with native manufacturing methods, or in any other case past the capabilities of deprived farmers to implement.

Folks depending on espresso farming for meals safety will face essentially the most vital boundaries. Smallholders will probably undergo decrease demand and earnings if banned from the world’s largest espresso market, resulting in unintended penalties.

This two-part article examines the challenges and attainable outcomes of EUDR by the lens of Timor-Leste, one of many world’s youngest and poorest nations. The conclusions reached, nonetheless, could also be instantly relevant to different smallholder espresso farming areas, or to different smallholder-farmed areas producing totally different shade-grown crops.

Timor-Leste

Timor-Leste, previously East Timor, is a small impartial nation established in 2002 that occupies the jap half of the Island of Timor, on the jap fringe of the Indonesian archipelago. It was a Portuguese colony from the sixteenth century till 1975, then gained independence for 9 days earlier than Indonesia invaded. Through the 25 years of Indonesian occupation that adopted, 180,000 Timorese died from hunger and battle, and over 80% of the nation’s infrastructure was destroyed. Now a sovereign nation, Timor-Leste stays one of many world’s poorest nations — a UN-designated Least Developed Nation the place half or extra Timorese reside in excessive poverty.

Espresso in Timor-Leste

Espresso has been one among Timor-Leste’s most vital money crops because the Portuguese launched it within the 1800s. At the moment accounting for 90% or extra of non-oil merchandise export worth, espresso is a crucial supply of meals safety for 77,000 rural households and a major supply of earnings for 37% of the nation’s inhabitants of 1.4 million.

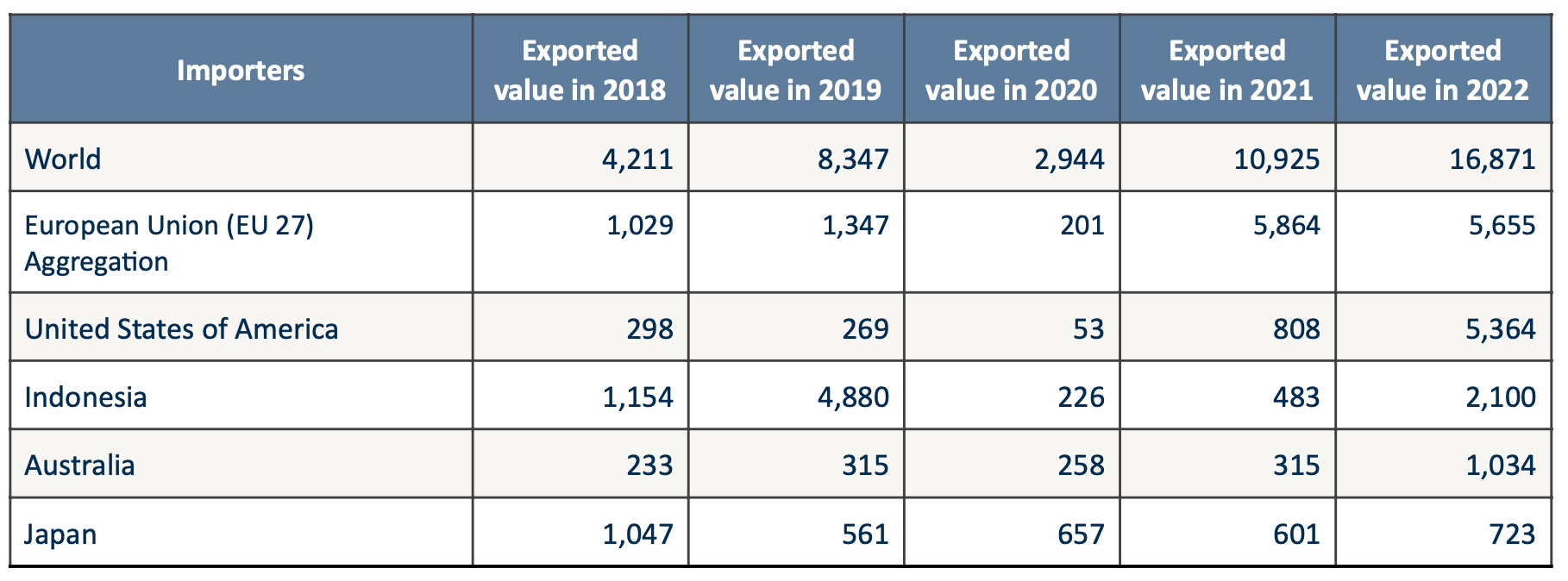

As a bloc, the European Union is the most important marketplace for Timor-Leste espresso. In 2022, the EU was the vacation spot for 33.5% of espresso exports by worth, and extra when contemplating transshipments by middleman nations for different causes, together with decaffeination.

ITC Trademap Information, HS 09011 (espresso not roasted or decaffeinated). Export worth from Timor-Leste in 1000’s of US {dollars}.

1000’s of semi-subsistence smallholder farmers produce Timor-Leste’s espresso as a forest crop shaded below steady cover. As espresso agriculture professional Tony Marsh noticed in 2001, “Arabica espresso is grown below shade in East Timor, because it doesn’t survive with out shade within the harsh, dry situations.”

Every family usually farms lower than one hectare, which can be unfold throughout a number of plots of land.

As soon as harvested, espresso cherries observe a fancy path to market, topic to the situation and functionality of every producer, in addition to any preexisting agreements. After arriving on the mill, coffees are comingled earlier than processing, sorting and grading for export. Almost all is exported as a money crop, with a small fraction of manufacturing consumed domestically.

Family earnings from espresso farming is usually lower than US$250 yearly, earned primarily through the harvest months of August and September. Farmers usually tend to undergo meals insecurity exterior harvest months, underscoring the significance of espresso as a money crop. Nonetheless, no higher options exist to generate rural earnings.

As one report on the Timor-Leste espresso sector famous, “Establishing various crops will contain main funding in any respect phases of the manufacturing and provide chain. This, nonetheless, is just not at the moment possible.

European Union Deforestation-free Regulation (EUDR)

EUDR entered into power on June 29, 2023. The regulation is meant “to ensure that the merchandise EU residents devour don’t contribute to deforestation or forest degradation worldwide.”

To perform this, EUDR regulates seven commodities linked to deforestation: cattle, cocoa, espresso, palm oil, rubber, soy, wooden and a few derived merchandise (i.e., roasted espresso). It requires that they be confirmed “deforestation-free,” as outlined by the EU since 2020, earlier than being allowed entry for authorized sale in Europe.

Enforcement begins in January 2025 for big corporations, with one other six months allowed for smaller corporations to conform. After that, companies that promote merchandise violating the regulation could also be fined as much as 4% of annual European turnover. This contains inexperienced espresso importers, roasters, and retailers who make espresso accessible on the market in Europe.

Why Espresso?

The seven regulated commodities have been chosen primarily based on an affiliation with deforestation and the EU share of world demand.

A demand examine in contrast the historic web improve in deforestation for every nation to the online improve in land use for producing a commodity over the identical interval. Outcomes indicated a proportion of “embodied deforestation” for every. For instance, “if espresso was liable for 5% land enlargement, then 5% of the nationwide deforestation could be attributed to the commodity.” Because the EU is the world’s largest marketplace for espresso imports, roughly 30% by amount, espresso rose to a stage of excessive significance for regulation regardless of being much less instantly linked to deforestation than different commodities.

A rural village settlement, or suco, adjoining to espresso farmed space of Timor-Leste. Picture by Andrew Hetzel.

Curiously, soluble espresso is excluded from regulation. Soluble or on the spot espresso is usually produced from espresso of the Robusta species. Robusta is grown primarily in Southeast Asia and West Africa, which skilled among the many highest charges of deforestation attributed to espresso in analysis supporting EUDR’s demand examine.

EUDR Necessities

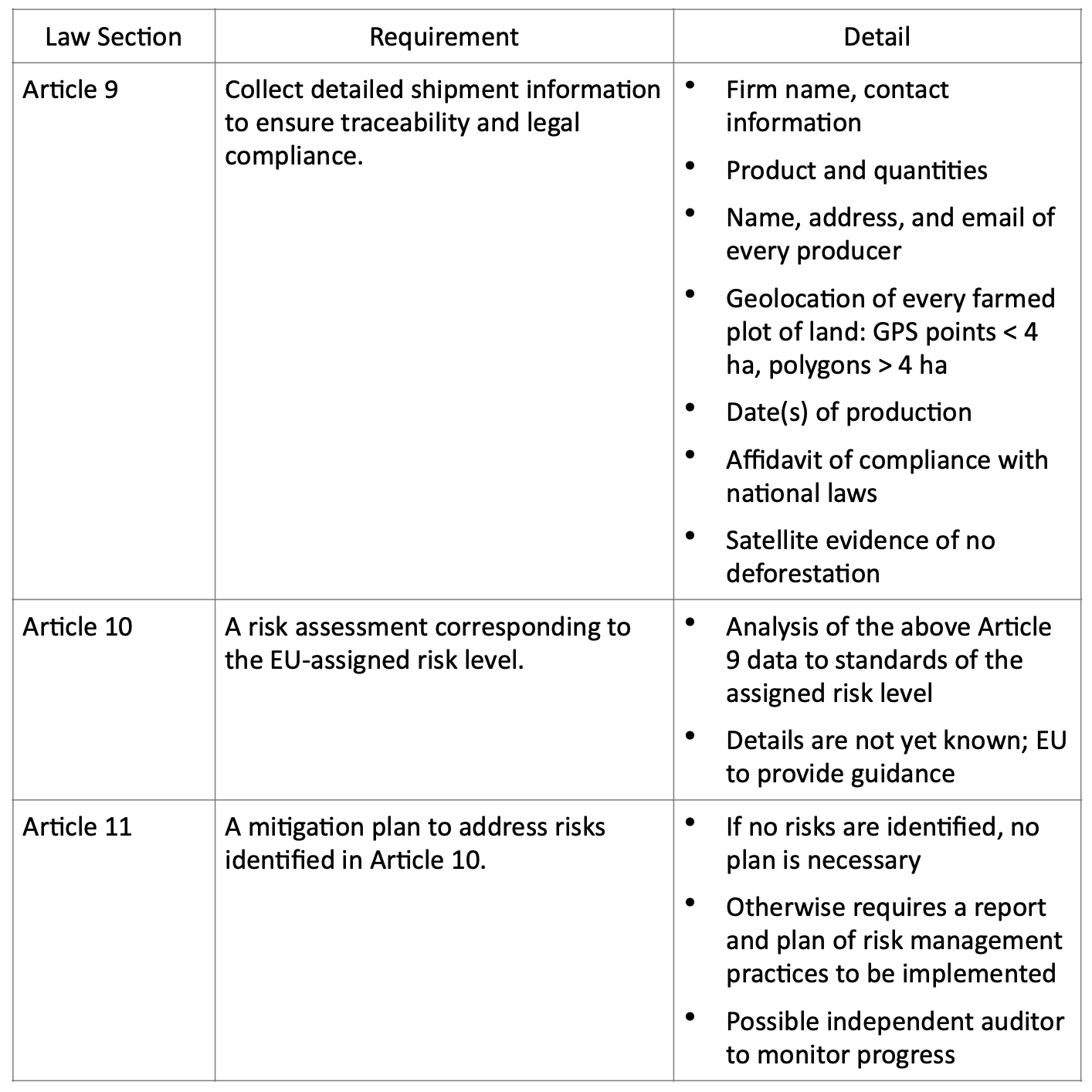

To adjust to EUDR, companies should carry out due diligence and hold detailed information in regards to the supply of every regulated commodity, verifying that no deforestation has occurred throughout the manufacturing space since 2020. The price of compliance and burden of proof is positioned on operators who make items accessible on the market within the EU.

Exporting nations may even be assigned a threat stage for deforestation (low, medium, or excessive) by the EU, figuring out the diploma of scrutiny given to its shipments. Notably, the extent of threat is aggregated throughout commodities, so all commodities might be handled as high-risk drivers of deforestation from a rustic the place any commodity is taken into account excessive threat.

Necessary particulars, resembling the standards used when assigning threat ranges, have but to be clarified by the EU, as of this writing.

Particularly, EUDR imposes three new necessities on importers:

Understanding these necessities and the realities dealing with smallholder farmers in Timor-Leste are important to understanding why compliance could also be not possible for a lot of. Keep tuned for Half 2 on this sequence, which is able to discover the real-world impacts the EUDR might have on smallholder farmers.

Feedback? Questions? Information to share? Contact DCN’s editors right here.

Andrew Hetzel

Andrew Hetzel is a espresso worth chain guide with 20 years of expertise working in smallholder farming communities of Southeast Asia, Africa, Latin America and the Center East. He’s a contracted adviser and group chief for a multi-government-funded agroforestry rehabilitation program in Timor-Leste.